Organization and information support of analysis

Question 1. Organizational forms and subjects of economic analysis

Organizational forms of economic analysis at an enterprise are determined by its size, industry, and legal form.

At large industrial enterprises, the activities of all economic services are headed by the chief economist - deputy director for economic issues.

He organizes all economic work at the enterprise, including economic analysis. He is subordinate to various economic services and departments (laboratory of economics and production organization, economic planning department, labor and wages department, financial department, etc.). A department or group of economic analysis can be allocated to a separate structural unit.

In medium and small enterprises, analytical work is headed by the head of the planning department or chief accountant.

Economic analysis is the responsibility of not only employees of economic services, but also technical departments (chief mechanic, power engineer, technologist, etc.). It is also carried out by shop services, heads of teams, sections, etc. Only through the joint efforts of economists, technicians, technologists, and managers of various production services, who have diverse knowledge on the issue under study, can it be possible to comprehensively study the problem posed and find the optimal solution to it. At the same time, however, one should remember the conclusion made by specialists in functional cost analysis: when cost reduction becomes everyone's business, it becomes no one's business.

The distribution of the main directions of economic analysis at the enterprise can be presented as follows:

· the economic planning department or the economic analysis department draws up a plan of organizational and technical measures and monitors its implementation, provides methodological support for the analysis, organizes and summarizes the results of the analysis of the activities of all divisions of the enterprise, develops measures based on the results of the analysis;

· accounting analyzes the implementation of production cost estimates, production costs, implementation of the profit plan and its use, financial condition, solvency of the enterprise, etc.;

· the labor and wages department analyzes the level of labor organization, the enterprise's supply of labor resources by profession and qualifications, the level of labor productivity, the use of the working time fund and the wage fund;

· the production department analyzes the implementation of the production plan in terms of volume and assortment, the rhythm of work, product quality, the introduction of new equipment and technologies, the consumption of material resources, the duration of the technological cycle, the general technical and organizational level of production;

· the department of the chief mechanic and power engineer studies the state of operation of machinery and equipment, the implementation of repair and modernization plans, the quality and cost of repairs, the use of equipment and production capacity, the rationality of energy consumption;

· the technical control department analyzes the quality of raw materials and finished products, defects and losses from defects, customer complaints,

· measures to reduce defects, improve product quality,

· compliance with technological discipline, etc.;

· the supply department controls the timeliness and quality of material and technical support for production, implementation of the supply plan in terms of volume, nomenclature, timing, quality, condition and safety of warehouse stocks, compliance with standards for the release of materials, transportation and procurement costs, etc.;

· The sales department studies the fulfillment of contractual obligations and plans for supplying products to consumers in terms of volume, quality, timing, nomenclature, the state of warehouse stocks and the safety of finished products.

Such joint work on analysis allows for a systematic approach and other principles to more fully identify and use existing reserves.

When starting to analyze financial and economic activities, it is recommended to first determine the specific goals of each procedure. Goals are determined by analysts taking into account the interests of users of the information that will be obtained from the results of the analysis. All analysts and users can be divided into two groups (Table 1.4) - external and internal. Their interests are different and often opposite. The basic principle, according to which certain categories of analysts and users are assigned to one group or another, is access to the information flows of the enterprise.

Internal users, conducting analysis or monitoring its implementation, can (to the extent of their competence, of course) receive any information relating to the current activities and prospects of the enterprise. External users have to be content only with information from official sources (primarily from financial statements) and base their conclusions on information that internal users found it possible to publish.

The first among internal users of analytical information should be called the management of an economic entity. For them, analysis is a necessary basis for making management decisions. Internal users also include owners of controlling blocks of property rights in enterprises (stocks, shares, shares, etc., depending on the form of ownership). In small enterprises, the owners themselves often carry out operational management, thus being not only the owners, but also the managers of their enterprises. In large joint-stock companies, the owners of large blocks control the composition of the board of directors and, therefore, through the managers, they can also have access to the maximum amount of information regarding the current situation and prospects of the enterprise.

All external analysts and users of information obtained as a result of analysis have very different goals. Thus, creditors (banks and financial organizations) and counterparties (suppliers, buyers, contractors, joint venture partners), when analyzing the financial and economic activities of an economic entity, want first of all to know whether it is possible to deal with it, what is its position on market and prospects for future activities, whether it faces bankruptcy. State regulatory authorities (tax, customs, statistics) analyze the financial and economic activities of enterprises to verify their compliance with legal requirements in areas within their competence.

Mergers and acquisitions specialists analyze mainly the prospects of enterprises from the point of view of the possibility and feasibility of carrying out their reorganization, i.e. pursue their own interests, sometimes (in the case of hostile takeovers) contrary to the interests of the owners, management and staff of the acquired company. M&A specialists have full access to important information only in the case of friendly takeovers, but in any case, this group of analysts studies the prospects of the company very carefully.

External users can also include small owners of enterprises (owners of small blocks of rights). According to the Russian Law on Joint Stock Companies, a shareholder has the right to receive information about the company's activities, but in reality it is only about access to official financial statements, which they can analyze themselves in order to get some idea of the state of affairs at the enterprise. Therefore, from the point of view of accessibility of information flows, small shareholders are considered external. The situation is similar for potential investors, even for those who intend to acquire a large package of rights. Not yet being shareholders, they, as a rule, do not have access to information other than official financial statements.

In separate categories, both among external and internal users and analysts, one can distinguish those who use techniques and methods of analysis in the course of their professional activities to perform purposes other than analytical: these are accountants and auditors - external and internal. Performing some analytical procedures is part of their daily professional responsibilities.

Enterprises provide financial statements to the following users:

Owners (participants, founders) in accordance with the constituent documents;

State Tax Inspectorate (in accordance with the legal address of the enterprise);

State statistics bodies for generalization and public use of information by external users;

Other government bodies responsible for checking certain aspects of the enterprise’s activities and obtaining relevant reports. These include, for example, financial authorities that finance enterprise expenses through allocations from the budget or budget loans;

State Property Committee bodies, ministries, departments submit reports to enterprises that are in state or municipal ownership in whole or in part, as well as privatized enterprises (including leased ones) created on the basis of state enterprises or their structural divisions, before the end of the redemption period. An enterprise's annual financial statements must be submitted no later than April 1 of the year following the reporting year.

Determining the quality of the financial condition, studying the reasons for its improvement or deterioration over the period, preparing recommendations to improve the financial stability and solvency of the enterprise are the main points of analyzing the financial condition. The detail of the procedural side of the financial analysis methodology depends on the goals set, as well as various factors of information, time, methodological and technical support. The effectiveness of financial analysis directly depends on the completeness and quality of the information used. Currently, some publications on financial analysis contain a simplified approach to the information support of financial analysis, focusing on the use exclusively of accounting (financial) statements or, in a somewhat broader sense, on accounting data.

Analysis of the financial condition of an enterprise is an integral part of general financial analysis. The financial results of an enterprise are characterized by the amount of profit received and the level of profitability. Profit represents the real part of the net income created by surplus labor. Only after the sale of the product (work, services) does net income take the form of profit. The amount of profit is determined as the difference between the proceeds from the economic activities of the enterprise (after payment of value added tax, excise tax and other deductions from proceeds to budgetary and extra-budgetary funds) and the sum of all costs for this activity.

Indicators of financial results (profit) characterize the absolute efficiency of the enterprise’s management in all areas of its activity: production, sales, supply, financial and investment. They form the basis for the economic development of the enterprise and the strengthening of its financial relations with all participants in the commercial business. Making a profit is the main goal of any business entity.

On the one hand, profit is an indicator of the efficiency of an enterprise, since it depends mainly on the quality of the enterprise’s work, increases the economic interest of its employees in the most efficient use of resources, since profit is the main source of production and social development of the enterprise. On the other hand, it serves as the most important source of formation of the state budget. Thus, both the enterprise and the state are interested in increasing profits.

Economic analysis occupies an intermediate place between collecting information and making management decisions, therefore its complexity, depth and effectiveness largely depend on the volume and quality of the information used. Economic analysis not only acts as a consumer of information, but also creates it for its own needs and management decisions. Information is usually understood as ordered information about processes and phenomena of the external world, a collection of any knowledge or data.

The value of economic information can be considered in three aspects: consumer - its usefulness for management, economic - its cost and aesthetic - its perception by a person. The value of information is usually determined by the economic effect of the functioning of the control object caused by its use value. The main requirement for information is its usefulness in decision making. To meet this requirement, information must be understandable, relevant, reliable, and also consistent with the idea of harmonization and standardization.

An important place in the organization of economic analysis at an enterprise is occupied by its information support. The analysis uses not only economic data, but also technical, technological and other information. All data sources for analysis are divided into regulatory planning, accounting and non-accounting.

Regulatory planning sources include all types of plans that are developed at the enterprise, as well as regulatory materials, estimates, etc. Sources of accounting information are all data that contain accounting, statistical and operational accounting documents, as well as all types of reporting, primary accounting documentation. Non-accounting sources of information are documents regulating economic activities, as well as data characterizing changes in the external environment of the enterprise. These include:

· official documents that the enterprise is obliged to use in its activities: state laws, orders of the president, government regulations, acts of audits and inspections, orders and instructions of managers, etc.;

· economic and legal documents: contracts, agreements, decisions of judicial authorities;

· scientific and technical information;

· technical and technological documentation;

· data on main competitors, information on suppliers and customers;

· data on the state of the market for material resources (market volumes, level and dynamics of prices for certain types of resources).

Thus, the information base for financial analysis is the entire information system of the enterprise, which includes:

· statistical reporting package;

· financial reporting package;

· internal documents of the enterprise;

· accounting registers;

· primary accounting documents;

· constituent documents;

· planning documentation;

· explanatory note to the annual financial report.

Currently, the financial (accounting) reporting of an organization is formed taking into account modern standards, since accounting is a tool for collecting, processing and transmitting information about the activities of an economic entity so that interested parties can better invest the funds at their disposal.

The financial statements of an organization can be used as information support for economic analysis: balance sheet, profit and loss statement, statement of changes in capital, cash flow statement.

The main requirement for the information presented in the reporting is that it be useful to users, i.e. so that this information can be used to make informed business decisions. To be useful, information must meet the following criteria:

· Relevance means that the information is significant and influences the decision made by the user. Information is also considered relevant if it allows for prospective and retrospective analysis;

· the reliability of information is determined by its veracity, the predominance of economic content over the legal form, the possibility of verification and documentary validity;

· information is considered truthful if it does not contain errors and biased assessments, and also does not falsify economic events;

· neutrality implies that financial reporting does not emphasize the interests of one group of users of general reporting to the detriment of another;

· understandability means that users can understand the content of the reporting without professional special training;

Comparability requires that data on the activities of an enterprise be comparable with similar information on the activities of other firms.

Analysis of financial indicators should be carried out using the following sources: “Report on financial results and their use”, “Balance sheet of the enterprise”, as well as according to accounting data, working materials of the financial department (service) and the legal adviser of the enterprise. To conduct a comparative analysis, it is recommended to use diverse information from other enterprises with similar activities that characterize their financial performance.

The financial result of an enterprise's activities is expressed in the change in the value of its equity capital for the reporting period. The ability of an enterprise to ensure steady growth of equity capital can be assessed by a system of financial performance indicators. The most important indicators of the financial performance of the enterprise are summarized and presented in Form No. 2 of the annual and quarterly financial statements.

These include: profit (loss) from sales; profit (loss) from financial and economic activities; profit (loss) of the reporting period; retained earnings (loss) of the reporting period.

The following indicators of financial results can also be calculated directly from the data in Form No. 2; profit (loss) from financial and other transactions; profit remaining at the disposal of the organization after paying income tax and other mandatory payments (net profit); gross income from the sale of goods, products, works, services. Form No. 2 also provides comparable data for the same period last year for all of the above indicators.

The financial results of an enterprise are expressed in the ability of a particular enterprise to increase its economic potential.

Analysis of economic activity is an important element in the production management system, an effective means of identifying on-farm reserves, the basis for the development of scientifically based plans, forecasts and management decisions and monitoring their implementation in order to improve the efficiency of the enterprise.

In modern conditions, the independence of enterprises in making and implementing management decisions, their economic and legal responsibility for the results of economic activity is increasing. Objectively, the importance of the financial stability of business entities is increasing. All this increases the role of financial analysis in assessing their production and commercial activities and, above all, the availability, placement and use of capital and income. The results of such an analysis are necessary, first of all, for owners (shareholders), creditors, investors, suppliers, tax authorities, managers and executives of enterprises.

Thus, information support for analyzing the efficiency of an enterprise is the most important characteristic when assessing the economic activity of an enterprise. Next, we will consider methods for assessing the financial and economic activities of an enterprise.

INTRODUCTION

organization enterprise financial economic

The relevance of the study is due to the fact that a market economy is associated with the need to increase production efficiency, competitiveness of products and services based on a systematic analysis of the financial and economic activities of the enterprise. Analysis of financial and economic activities makes it possible to develop the necessary strategy and tactics for the development of the enterprise, on the basis of which a production program is formed, and reserves for increasing production efficiency are identified.

The purpose of the analysis is not only to establish and evaluate the effectiveness of the financial and economic activities of the enterprise, but also to constantly carry out work aimed at improving it.

Analysis of the effectiveness of the financial and economic activities of an enterprise shows in which areas this work should be carried out and makes it possible to identify the most important aspects and weakest positions in the financial condition of the enterprise. In accordance with this, the results of the analysis answer the question of what are the most important ways to improve the financial condition of an enterprise in a specific period of its activity. But the main goal of the analysis is to promptly identify and eliminate shortcomings in financial activities and find reserves for improving the financial condition of the enterprise and its solvency.

Financial analysis is a flexible tool in the hands of enterprise managers. The efficiency of the financial and economic activities of an enterprise is characterized by the placement and use of enterprise funds. This information is presented in the balance sheet of the enterprise.

The main factors determining the effectiveness of the financial and economic activities of an enterprise are, firstly, the implementation of the financial plan and the replenishment, as the need arises, of its own working capital at the expense of profits and, secondly, the turnover rate of working capital (assets).

The signal indicator in which the effectiveness of financial and economic activities is manifested is the solvency of the enterprise, which means its ability to satisfy payment requirements on time, repay loans, pay staff, and make payments to the budget.

The analysis of the effectiveness of the financial and economic activities of an enterprise includes an analysis of the balance sheet of liabilities and assets, their relationship and structure; analysis of capital use and assessment of financial stability; analysis of the solvency and creditworthiness of the enterprise, etc.

Thus, it is clear how important it is to assess the effectiveness of the financial and economic activities of an enterprise, and that this problem is even more relevant in the transition to a developed market economy.

This work consists of an introduction, three chapters and a conclusion. The first chapter analyzes the main theoretical aspects of the analysis of financial and economic activities: concept, goals, foundations of organization, features, organizational forms and performers. The second chapter reveals sources of information to provide analysis of the enterprise, preparation and processing of data, and documentation. The third chapter provides a practical justification for the topic using the example of the Open Joint Stock Company TAIF-NK.

1.1 Basics of organizing business analysis

Increasing business efficiency largely depends on the validity, timeliness and expediency of management decisions made. All this can be achieved through the analysis process. However, only properly organized work on analytical research of business results can ensure its effectiveness and efficiency and fundamentally influence the course of business processes. Therefore, the organization of ACD at an enterprise must meet a number of requirements. Among them, it is necessary to note the scientific nature of the analysis. In practice, this means that it should be based on the latest achievements of science and best experience, built taking into account the operation of economic laws within a particular enterprise, and carried out using scientifically based methods. Conducting analysis should become an organic part of the job responsibilities of every specialist, manager of different levels of the economy, and the responsibility of all employees who are involved in making management decisions. This implies another important principle for organizing the analysis - a reasonable distribution of responsibilities for conducting ACD between individual performers. Not only the completeness of coverage of the objects of analysis depends on how expedient this distribution is, but also excludes the possibility of repeated (by different persons) conducting the same studies. This contributes to a more efficient use of specialists’ working time and ensures comprehensive analysis.

Analytical research must be effective, which means that the costs of its implementation should be minimal with optimal depth of analysis and its complexity. For this purpose, in addition to the expediency of the organization, when conducting it, advanced techniques and tools that facilitate the work of the analyst should be widely used. Here, first of all, we mean rational methods of collecting and preserving, introducing data into the practice of AHD of PCs and other technical means, office equipment.

A more thorough organization of ACD is achieved by unifying this work. Here we mean the creation of methods that would provide for filling out a limited number of specially designed tables. They must be specific for each business unit and together provide a comprehensive picture of business results. All table indicators must be suitable for comparison, evaluation, and generalization. This creates a direction for a strictly defined distribution of responsibilities for conducting ACD, reduces the time spent on analysis and ultimately helps to increase its efficiency.

1.2 Information support for business activity analysis

To planned sources include all types of plans that are developed at the enterprise (prospective, current, operational, self-supporting tasks, technological maps), as well as regulatory materials, estimates, price tags, design assignments, etc.

Sources of accounting information This is all data that contains documents, accounting, statistical and operational records, as well as all types of reporting, primary accounting documentation.

The leading role in the information support of analysis belongs to accounting and reporting, where economic phenomena, processes, and their results are most fully reflected. Timely and complete analysis of the data available in accounting documents (primary and consolidated) and reporting ensures the adoption of the necessary measures aimed at improving the implementation of plans and achieving better business results.

Statistical data, which contains quantitative characteristics of mass phenomena and processes, is used for in-depth study and understanding of relationships, identifying economic patterns.

Operational accounting and reporting contributes to a more efficient provision of analysis with the necessary data (for example, on production and shipment of products, on the state of inventories) compared to statistics or accounting, and thereby creates conditions for increasing the efficiency of analytical research.

An accounting document, according to our qualifications, is also an economic passport of an enterprise, which accumulates data on the results of economic activities over several years. Significant detail of the indicators contained in the passport allows for numerous studies of dynamics, identifying trends and patterns of enterprise development.

TO off-account sources of information include documents that regulate economic activities, as well as data that does not relate to those listed earlier. Specifically, these include the following documents:

1. Official documents that enterprises are obliged to use in their activities: state laws, presidential decrees, government and local government resolutions, orders of higher authorities, acts of audits and inspections, orders and instructions of business managers

2. Economic and legal documents: contracts, agreements, arbitration and judicial decisions, complaints.

3. Decisions of general meetings of the collective, the council of the labor collective of the enterprise as a whole or its individual subdepartments.

4. Materials for studying best practices. Acquired from various sources of information (radio, television, newspapers, etc.).

5.Technical and technological documentation.

6. Materials from social studies of the state of production at individual workplaces (timing, photography, etc.).

7. Oral information received during meetings with members of your team or representatives of other enterprises.

There are a number of requirements for organizing information support for analysis. This - analyticity of information, its objectivity, unity, efficiency, rationality .

The meaning of the first requirement is that the entire system of economic information, regardless of sources of receipt, must meet the needs of AHD, i.e. ensure the flow of data precisely on those areas of activity and with the detail that the analyst needs at this moment for a comprehensive study of economic phenomena and processes, identifying the influence of main factors and identifying on-farm reserves for increasing production efficiency. Therefore, the entire AHD information support system must be constantly improved. This is obvious in today's practice of organizing accounting, planning and statistics in an enterprise. There, the forms of documents, their contents, and the organization of document flow are constantly being revised, and fundamentally new forms of accumulating and storing data (meaning computer technology) appear. All changes are dictated not only by one’s own accounting or planning requirements. They are largely subordinated to the need for information support for ACD and the development of management decisions.

Economic information must objectively reflect the phenomena and objects being studied. Otherwise, the conclusions drawn from the analysis will not correspond to reality, and the proposals developed by analysts will not only not benefit the enterprise, but may become harmful. The next requirement for the organization of information flow is the unity of information coming from different sources (planned, accounting and non-accounting). From this principle follows the need to eliminate the isolation and duplication of different sources of information. This means that each economic phenomenon, each business act should be registered only once, and the results obtained can be used in accounting, planning, control and analysis.

The effectiveness of analysis can be ensured only when it is possible to promptly intervene in the production process based on its results. This means that information must reach the analyst as quickly as possible. This is the essence of another information requirement - efficiency . Increasing the efficiency of information is achieved by using the latest means of communication and processing it on a computer.

And finally the information system must be rational (effective), that is, to require a minimum of costs for collecting, storing and using data. At the same time, it should provide analysis and management requests as fully as possible. This requirement implies the need to study the usefulness of information and, on this basis, improve information flows by eliminating unnecessary data and introducing necessary ones. Thus, the ACD information system must be formed and improved taking into account the requirements listed above, which is a necessary condition for increasing the efficiency and effectiveness of ACD.

1.3 Organizational forms and performers of analysis of economic activities of enterprises

The organizational forms of analysis of the economic activity of an enterprise are determined by the composition of the apparatus and the technical level of management.

At large industrial enterprises, the activities of all economic services are managed by the chief economist, who is the deputy director for economic issues. He organizes all economic work at the enterprise, including the analysis of economic activities. Directly subordinate to him are the laboratory of economics and production organization, economic planning department, labor and wages departments, accounting, financial, etc. An economic analysis department or group may be allocated to a separate unit. At medium and small enterprises, the analytical work is headed by the head of the planning department or the chief accountant. To coordinate analytical work, technical and economic councils can also be created, which include heads of all departments and services of the enterprise.

Economic analysis is the responsibility of not only employees of economic services, but also technical departments (chief mechanic, power engineer, technologist, new equipment, etc.). It is also carried out by shop services, heads of teams, sections, etc. Only through the joint efforts of economists, technicians, technologists, and managers of various production services, who have diverse knowledge on the issue under study, can it be possible to comprehensively study the problem posed and find the most optimal solution to it.

An approximate diagram of the distribution of functions for analyzing economic activity can be presented as follows.

Production Department analyzes the implementation of the production plan in terms of volume and assortment, rhythm of work, improvement of product quality, introduction of new equipment and technologies, comprehensive mechanization and automation of production, equipment operation, consumption of material resources, duration of the technological cycle, completeness of product output, general technical and organizational level of production .

Department of Chief Mechanic and Power Engineer study the operating conditions of machinery and equipment, the quality and cost of repairs, the complete use of equipment and production capacity, and the rationality of energy consumption.

Technical control department analyzes the quality of raw materials and finished products, defects and losses from defects, customer complaints, measures to reduce defects, improve product quality, adherence to technological discipline, etc.

Purchase department controls the timeliness and quality of material and technical support for production, implementation of the supply plan in terms of volume, nomenclature, timing, quality, condition and safety of warehouse stocks, compliance with standards for the release of materials, transportation and procurement costs, etc.

Sales department studies the fulfillment of contractual obligations and plans for supplying products to consumers in terms of volume, quality, timing, nomenclature, state of warehouse stocks and safety of finished products.

Department of Labor and Wages analyzes the level of labor organization, implementation of the action plan to improve its level, the enterprise's supply of labor resources by category and profession, the level of labor productivity, use of the working time fund and the wage fund.

Accounting and Reporting Department analyzes the implementation of production cost estimates, production costs, implementation of the profit plan and its use, financial condition, solvency of the enterprise, etc.

Planning and Economic Department or economic analysis department carries out the drawing up of an analytical work plan and monitoring its implementation, methodological support for the analysis, organizes and summarizes the results of the analysis of the economic activities of the enterprise and its structural divisions, and develops measures based on the results of the analysis.

Such joint work on carrying out ACD makes it possible to ensure its complexity and, most importantly, in a more qualified manner, to deeply study economic activity, its results, and to more fully identify unused reserves.

The enterprise is analyzed periodically higher management bodies. Specialists from these bodies can study individual issues or conduct a comprehensive analysis of the enterprise’s economic activities. Based on the results of this analysis, management bodies can to some extent change some of the conditions of the enterprise.

Non-departmental AHD carried out by statistical, financial authorities, tax inspectorates, auditing firms, banks, investors, research institutes, etc. Statistical bodies, for example, summarize and systematize statistical reporting and provide the results to the relevant ministries and departments for practical use. Tax inspectorates analyze the implementation of enterprise plans for profit, for the deduction of taxes to the state budget, and monitor the rational use of material and financial resources. Banks and other investors study the financial position of the enterprise, its solvency, creditworthiness, efficiency of use of loans, etc.

Enterprises can also use the services of specialists from auditing and consulting firms.

The use of all forms of on-farm, departmental, non-departmental and public control and analysis creates opportunities for a comprehensive study of the economic activities of the enterprise and the most complete search for reserves for increasing production efficiency.

2.1 Planning analytical work

An important condition on which the effectiveness and efficiency of ACD depends is the systematic nature of its implementation. Only when the analytical study of each individual issue of economic activity has a certain meaning, purpose and place in the system of studying and managing an enterprise, can the analysis acquire significant value for business practice. Therefore, at each enterprise, all analysis work must be planned. In practice, the following plans can be drawn up:

Comprehensive plan for the analytical work of the enterprise

Thematic plans.

Comprehensive plan usually drawn up for one year. It is developed by a specialist who is entrusted with the management of the analytical work as a whole at the enterprise. This content plan represents a calendar schedule of individual analytical studies. In addition to the goals and objectives of the analysis, it lists the issues that must be investigated throughout the year, determines the time for studying each issue, the subjects of analysis, provides a diagram of the analytical workflow, the deadline and address for the receipt of each document, and its content.

When developing a plan, the frequency of studying important problematic issues and the continuity of analysis over individual periods of time must be taken into account.

The comprehensive plan should also provide for sources of information that can be used in the analysis, and technical means for carrying out the analysis. For example, when performing research on a PC, a program must be determined according to which the analysis will be carried out. Based on the results of the analysis, proposals are developed aimed at improving business results. Therefore, a comprehensive plan must also include the organization of monitoring the implementation of these activities.

In addition to a comprehensive plan, the farm can also draw up thematic. These are plans for conducting analysis on complex issues that require in-depth study. They discuss objects, subjects, stages, timing of analysis, its performers, etc.

Monitoring the implementation of analysis plans is carried out by the deputy head of the enterprise for economic issues or the person entrusted with the responsibility for managing the analysis as a whole.

2.2 Preparation and analytical processing of source data in the analysis of economic activities

The critical stage in the AHD is the preparation of information, which includes checking the data, ensuring their comparability, and simplifying numerical information. First of all, the information collected for analysis must be checked for good quality. The check is carried out on both sides. First, the analyst checks how complete the data that plans and reports contain is and whether they are formatted correctly. It is imperative to check the correctness of arithmetic calculations and the compliance of the indicators contained in the planning documentation with the approved plan targets. The analyst should also pay attention to whether the indicators given in different tables and plans or reports are consistent. d. Such verification is of a technical nature. Secondly, the milestones involved in the data analysis are checked on their merits.

In the process, it is determined to what extent this or that indicator corresponds to reality. The main question that the analyst solves can be formulated as follows: can this really happen? The means of this check are both logical comprehension of the data and checking the state of accounting, the mutual consistency and validity of indicators from different sources. The analysis will be much less labor-intensive if comparability of indicators is ensured. To do this, all numerical information, after checking its quality, is brought into a comparable form. In this case, the following requirements must be taken into account:

Unity of volumetric, cost, quality, structural factors.

The unity of the intervals or moments of time for which the calculated indicators were calculated;

Comparability of initial production conditions (technical, natural, climatic, etc.)

Unity of calculation methods and their composition.

Analytical research is often predictive in nature and does not require such accuracy as, for example, in accounting. Therefore, in order to facilitate the perception of information and reduce the volume of analytical calculations (when they are not carried out on a computer), you can discard the decimal places of numbers and carry out calculations in rubles or thousands of rubles. However, one caution needs to be made here. The choice of the degree of simplification depends on the content of the indicator, its value, etc. For example, to estimate capital productivity, you don’t have to take the exact cost of fixed assets and gross output; it is enough to have their volumes in thousands of rubles. But by discarding the decimal places in the capital productivity indicator itself, we will most often lose its value altogether - it will turn to zero. With this simplification, it is necessary to preserve 2-3 decimal places. When simplifying the source data, average or relative values are often determined, which makes it easier to generalize.

Analytical data processing- this is direct analysis. Therefore, it is a more critical stage of the analyst’s work. The organization of processing requires appropriate methodological support, a certain level of training of the persons involved in the analysis, and their provision with the technical means of conducting ACD. Responsibility for all this most often rests with the specialist who manages the analytical work at the enterprise. He is obliged to constantly improve the ACD methodology based on studying the achievements of science and advanced experience in the field of analysis and implement it in all areas of production.

2.3 Documentation of analysis results

Any results of an analytical study of the activities of the enterprise as a whole or its divisions must be documented.

It could be explanatory note, certificate, conclusion .

An explanatory note is usually drawn up when sending the results to a higher organization. If the results of the analysis are intended for on-farm use, they are issued in the form of a certificate. The conclusion is written when the analysis is carried out by higher authorities.

Contents of the explanatory note must be sufficiently complete. In addition to conclusions about the results of economic activities and proposals for their improvement, the explanatory note should contain general issues - the economic level of the economy, business conditions, the results of implementing plans for individual areas of activity. The analytical part of the explanatory note must be reasonable and specific in style. It may contain analytical calculations themselves, tables where the data necessary for illustration is grouped, graphs, diagrams, etc. When preparing it, special attention should be paid to proposals made based on the results of the analysis. First of all, they must be comprehensively justified and aimed at improving the results of economic activities and developing the identified on-farm reserves.

As for the certificate and conclusion, their content, in contrast to the explanatory note, can be more specific, focused on reflecting shortcomings or achievements, identified reserves, and methods for their development. Here the general characteristics of the enterprise and the conditions of its activity may be omitted.

Special attention should be paid to textless form of presentation of analysis results. It consists of a permanent package of standard analytical tables and does not contain explanatory text. Analytical tables allow you to systematize, summarize the material being studied and present it in a form suitable for perception. The forms of tables can be very diverse. They are built in accordance with the data required for analysis. Indicators in analytical tables must be placed in such a way that they are simultaneously used as analytical and illustrative material. At the same time, there is no need to strive to present all the indicators of farm performance in one table or rush to the other extreme - enter many tables. Both their universality and their immense quantity complicate their use. Analytical tables should be clear and easy to use.

This order of presentation of analysis results has recently found increasing use. It is designed for highly qualified workers who are able to independently understand processed and systematized information and make the necessary decisions. Textless analysis increases its effectiveness because it reduces the gap between performing the analysis and using its results.

In practice, the most significant results of the analysis can be entered into sections specially provided for this purpose. economic passport of the enterprise. The availability of these data for several years allows us to consider the results of economic activity in dynamics and ensures its continuity over individual periods of time.

It is advisable to discuss the results of the analysis and the measures developed on their basis at meetings of the team of the enterprise and its divisions. They receive practical implementation after appropriate resolutions of team meetings, orders from production management or higher management bodies.

2.4 Organization of computer processing of economic information

Analytical processing of economic information is very labor-intensive in itself and requires a large amount of various calculations. With the transition to market relations, the need for analytical information increases significantly. This is due, first of all, to the need to develop and substantiate long-term business plans for an enterprise, and to comprehensively assess the effectiveness of short-term and long-term management decisions. In this regard, automation of analytical calculations has become an objective necessity.

The computing tools that enterprises and organizations now have make it possible to completely automate the processing of all economic data, including the analysis of economic activity. The role of automation of analytical calculations is as follows.

Firstly, the productivity of economists and analysts increases. They are freed from technical work and are more engaged in creative activities, which allows them to do more in-depth research and pose more complex economic problems.

Secondly, economic phenomena and processes are studied more deeply and comprehensively, factors are more fully studied and reserves for increasing production efficiency are identified.

Thirdly, the efficiency and quality of analysis, its overall level and effectiveness are increased.

Automation of analytical calculations and the analysis of economic activity itself has risen to a higher level with the use of personal computers, which are characterized by high productivity, reliability and ease of operation, the presence of developed software, interactive mode of operation, low cost, etc. On their basis, automated workstations of accountants and economists are created , financier, analyst, etc. PCs connected into a single computer network make it possible to move to comprehensive automation of ACD.

3.1 General characteristics of the financial and economic activities of PSC TAIF-NK

Open Joint Stock Company "TAIF-NK", hereinafter referred to as the "Company", was created on the basis of a decision of the Board of Directors of TAIF PSC.

The main goal of TAIF-NK PSC is to earn profit from the sale of petroleum products and their derivatives, the construction and operation of industrial production, and other types of activities not prohibited by current legislation.

PSC TAIF-NK carries out all types of foreign economic activities not prohibited by current legislation.

The governing bodies of TAIF-NK PSC are the general meeting of shareholders; Board of Directors; sole executive body (General Director or management organization, manager);

The authorized capital of the company is fully formed through the monetary contribution of the sole founder - TAIF PSC. There are no contributions to the authorized capital of other founders.

Open Joint Stock Company TAIF-NK is one of the most dynamically developing enterprises in the universal fuel and raw materials sector, created in order to satisfy consumer demand for petroleum products and provide raw materials for petrochemical production.

Let's consider the technical and economic indicators of PSC TAIF-NK for 2006-2008. in table 1.

Table 1 - Technical and economic indicators of TAIF-NK PSC

| Index | 2006 | 2007 | Deviation from 2007 to 2006 | 2008 | Deviation from 2008 to 2007 | ||

| Absolute deviation | % | Absolute deviation | % | ||||

| Output of commercial products, million rubles. | 54877 | 65358 | 10481 | 119,1 | 89131 | 23773 | 136,4 |

| Sales of products, million rubles. | 55465 | 64621 | 9156 | 116,5 | 89149 | 24528 | 137,9 |

| incl. export sales, million rubles. | 29016 | 35 241 | 6225 | 121,5 | 43 793 | 8552 | 124,3 |

| Costs per 1 rub. commodity prod., kop. | 88 | 83 | -5 | 94 | 80 | -3 | 96 |

| Net profit, million rubles. | 1954 | 4582 | 2628 | 234,5 | 5272 | 690 | 115,1 |

| Capit. investments, million rubles | 1739 | 8732 | 6993 | 502,1 | 2027 | -6705 | 23,2 |

| Net assets, million rubles. | 1440 | 5436 | 3996 | 377,5 | 16557 | 11121 | 304, 6 |

| Monthly salary, in rub. | 21532 | 23562 | 2030 | 109,4 | 28249 | 4687 | 119,9 |

| Average number of employees, people. | 2428 | 2616 | 188 | 107,7 | 2718 | 102 | 103,9 |

Analyzing the table's indicators, we see that in 2007 commercial products were produced in the amount of 65.4 billion rubles, which is 10.5 billion rubles more than the level of 2006; as for 2008, there is also a positive trend. In 2008, compared to 2007, commercial products were produced by 23.8 billion rubles more. At comparable prices in 2007, the volume of commercial output compared to the level of 2006 was 119.1%, in 2008 compared to the level of 2007 it was 136.4%. In 2008, products and services were sold in the amount of 89.1 billion rubles, which is 24.5 billion rubles. The share of exports in products sold in 2007 was 54.5%, in 2008 – 49.1%. During 2007, the cost of capital investments of the Company increased by 6993 million rubles, in 2008 compared to 2007 it decreased by 6.7 billion rubles. It should be noted that the cost of costs per 1 ruble of commercial products decreased in 2007 compared to 2006 by 5 kopecks, and in 2008 compared to 2007 by 3 kopecks, which is a positive moment in the activities of the enterprise.

In 2008, the output of commercial products increased by 136.4% and amounted to 89,131 million rubles. Net profit in 2008 increased compared to 2007 by 115.1% or by 690 million rubles.

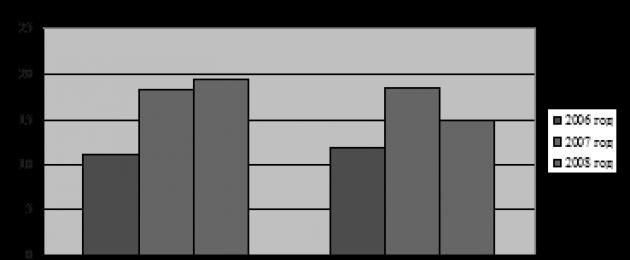

Dynamics of the main technical and economic indicators of PSC TAIF-NK for 2006-2008. is clearly presented in Figure 1.

Figure 1 - Dynamics of the main technical and economic indicators of TAIF-NK PSC for 2006-2008, billion rubles.

One of the main directions of analysis of the economic activity of an enterprise is the horizontal and vertical analysis of the financial statements of the enterprise.

Table 2 - Composition and structure of assets on the balance sheet of PSC TAIF-NK

| Balance sheet asset | 2006 | 2007 | 2008 | |||

| thousand roubles. | % | thousand roubles. | % | thousand roubles. | % | |

| Fixed assets | 11 047 393 | 48,4 | 18 255 249 | 49,6 | 19 482 402 | 56,4 |

| Current assets | 11 788 610 | 51,6 | 18 551 416 | 50,4 | 15 052 116 | 43,6 |

| Total property | 22 836 003 | 100,0 | 36 806 665 | 100,0 | 34 534 518 | 100,0 |

Let's consider the composition and structure of the asset balance sheet of PSC TAIF-NK for 2006-2008. (table 2). The presented data allows us to draw the following conclusions:

The table data shows that in 2007 the value of property compared to 2006 increased by 13,970,662 thousand rubles or by 61.2%, and in 2008 the value of property of the enterprise decreased by 2,272,147 thousand rubles compared to 2007 (6.2%) and amounted to 34,534,518 thousand rubles.

To illustrate the changes in the enterprise’s assets, let’s present their dynamics in Figure 2 for the analyzed period.

Figure 2 - Dynamics of changes in assets of PSC TAIF-NK for 2006-2008, billion rubles.

The amount of non-current assets in 2007 compared to 2006 increased by 7,207,856 thousand rubles, and in 2008, compared to 2007, the amount of fixed capital placed in the form of non-current assets increased by 1,227,153 thousand rubles and amounted to 19,482,402 thousand . rubles.

In 2007, there was an increase in the amount of current assets compared to 2006 by 6,762,806 thousand rubles, and in 2008, the amount of working capital compared to 2007 decreased by 3,499,300 thousand rubles and amounted to 15,052,116 thousand rubles. The decrease in the amount of current assets is associated with a decrease in inventories from 4,915,930 thousand rubles to 2,818,155 thousand rubles and a decrease in accounts receivable by 2,096,089 thousand rubles.

It should also be noted that short-term financial investments increased in 2008 compared to 2007 by 1,370,754 thousand rubles.

The main source of capital formation is borrowed and own funds. The composition and structure of the balance sheet liabilities of PSC TAIF-NK is presented in Table 3.

Table 3 - Composition and structure of the liabilities side of the balance sheet of PSC TAIF-NK

An analysis of the table indicators indicates that in 2007 the value of liabilities compared to 2006 increased by 13,970,662 thousand rubles or 61.2%, and in 2008 the value of the enterprise’s liabilities decreased by 2,272,147 compared to 2007 thousand rubles (6.2%) and amounted to 34,534,518 thousand rubles.

The amount of capital and reserves in 2007 compared to 2006 increased by 3,996,145 thousand rubles, and in 2008 compared to 2007, the amount of capital increased by 11,121,560 thousand rubles (204.6%) and amounted to 16,557,481 thousand rubles.

In 2007, there was an increase in the amount of long-term liabilities compared to 2006 by 864,048 thousand rubles, and in 2008, the amount of long-term liabilities compared to 2007 increased by 3,757,985 thousand rubles (40.5%) and amounted to 13,047 728 thousand rubles. It should also be noted that there was a significant decrease in the amount of short-term liabilities in 2008 compared to 2007 by 77.6% or 17,151,692 thousand rubles.

Figure 3 shows the change in the amount of liabilities on the balance sheet of the enterprise under study; the dynamics are not stable.

Figure 3 - Dynamics of changes in the liabilities side of the balance sheet of PSC TAIF-NK for 2006-2008, billion rubles.

Let us analyze the capital productivity and capital intensity of the enterprise under study for the period 2006-2008. Capital productivity is an indicator of the efficiency of use of fixed assets, calculated as the annual output divided by the cost of the fixed assets with which these products were produced. Capital intensity is an indicator characterizing the efficiency of an enterprise's economic activities, calculated as the ratio of the cost of annual production to the cost of fixed assets.

Fo 2006 =54,877/9,167= 5.9

Fo 2007 =65,358/17,198= 3.8

Fo 2008 =89,131/15,167= 5.8

Fe 2006 =9,167/54,877= 0.16

Fe 2007 =17,198/65,358= 0.26

Fe 2008 =15,167/89,131= 0.17

In general, it can be noted that in 2007 the efficiency of use of fixed assets decreased, but already in 2008 this indicator has a positive trend, which certainly indicates an improvement in the use of fixed assets.

3.2 Analysis of the dynamics and structure of profit

The financial results of an enterprise can be characterized by the amount of profit received and the level of profitability.

The relevance of studying the analysis of financial results lies in the fact that it allows us to determine the most rational ways of using resources and form the structure of the enterprise’s funds and activities as a whole.

Profit is the part of net income that business entities directly receive after selling products. Quantitatively, it represents the difference between net revenue (after payment of VAT, excise tax and other deductions from revenue to budgetary and extra-budgetary funds) and the full cost of products sold. The more a company sells profitable products, the more profit it will receive, and the better its financial condition. Therefore, financial performance results should be studied in close connection with the use and sale of products. The volume of sales and the amount of profit, the level of profitability depend on the production, supply, marketing and financial activities of the enterprise.

Let us analyze the composition and dynamics of the formation of financial results (Table 4). The profit and loss statement allows you to evaluate the activities of the enterprise for a certain period. Unlike the balance sheet, which gives an idea of the state of funds and their sources as of a certain date, the profit and loss statement characterizes the dynamics of the economic process.

Table 4 - Composition and dynamics of formation of financial results

Profit from sales of products is the difference between the amount of gross profit and fixed costs of the reporting period. In 2007, profit from sales increased compared to the previous year, the total change in profit from sales of goods, products, works, services for the year was:

In absolute terms: 9168000 thousand rubles. – 5598000 thousand rubles. = -3570000 thousand rubles.

In relative terms: 9168000 / 5598000 * 100% = 163.8%

Those. in 2007, profit from the sale of goods, products, works, and services increased by 3,570,000 thousand rubles. (or 63.8%).

In 2008, profit from sales increased compared to 2007, the total change in profit from sales of goods, products, works, services for the year was:

In absolute terms: 10,695,000 thousand rubles. – 9168000 thousand rubles. = -1527000 thousand rubles.

In relative terms: 10695000 / 9168000 * 100% = 116.7%

Those. in 2008, profit from the sale of goods, products, works, and services increased by 1,527,000 thousand rubles. (or 16.7%).

Change in interest receivable 2007 compared to the previous year:

In absolute terms: 47,239 thousand rubles. -24780 thousand rubles. = 22459 thousand rubles.

In relative terms: 47239 / 24780 * 100% = 190.6%

Those. in 2007, interest receivable increased by 22,459 thousand rubles (or 90.6%).

In absolute terms: 247,570 thousand rubles. – 47239 thousand rubles. = 200331 thousand rubles.

In relative terms: 247570 / 47239 * 100% = 524%

Those. in 2008, interest receivable increased by 200,331 thousand rubles. (or 424%).

Change in interest payable in 2007 compared to the previous year:

In absolute terms: 1,046,056 thousand rubles. –1301596 thousand. rub. = – 255540 thousand rubles.

In relative terms: 1046056 / 1301596 thousand * 100% = 80.4%

Those. in 2007, interest receivable decreased by 255,540 thousand rubles. (or 19.6%).

Change in interest receivable 2008 relative to 2007:

In absolute terms: 779866 thousand rubles. -1046056 thousand rubles. = =-266190 thousand rubles.

In relative terms: 779866 / 1046056 * 100% = 74.5%

Those. in 2008, interest receivable decreased by 266,190 thousand rubles. (or 25.5%).

Operating income is the income of an enterprise due to financial, production, and business operations carried out over a certain period. Operating income data is published in the annual income statement.

Change in operating income in 2007 compared to the previous year:

In absolute terms: 54951884 thousand rubles. – 42096562 thousand rubles. = 12855322 thousand rubles.

In relative terms: 54951884 thousand rubles. / 42096562 thousand rubles. * 100% = 130.5%

Those. in 2007, operating income increased by 12,855,322 thousand rubles. (or 30.5%).

Change in operating income in 2008 compared to the previous year:

In absolute terms: 57090472 thousand rubles. – 54951884 thousand rubles. = 2138588 thousand rubles.

In relative terms: 57090472 thousand rubles. / 54951884 thousand rubles * 100% = 103.9%

Those. in 2008, operating income increased by 2,138,588 thousand rubles. (or 3.9%).

Operating expenses are costs and payments associated with carrying out financial, production, and business operations over a certain period of time.

Operating expenses include production and sales costs, administrative and financial expenses. Operating expenses are published in the annual income statement.

Change in operating expenses in 2007 compared to the previous year:

In absolute terms: 54878283 thousand rubles. – 42148660 thousand rubles. = 12729623 thousand rubles.

In relative terms: 54878283 thousand rubles. / 42148660 thousand rubles. * 100% =130.2%

Those. in 2007, operating expenses increased significantly by 12,729,623 thousand rubles. (or 30.2%).

Change in operating expenses in 2008 compared to 2007:

In absolute terms: 59909421 thousand rubles. – 54878283 thousand rubles. = 5031138 thousand rubles.

In relative terms: 59909421 thousand rubles. / 54878283 thousand rubles. * 100% =109.2%

Those. in 2008, operating expenses increased by 5,031,138 thousand rubles (or 9.2%).

The income and expenses of the enterprise are clearly presented in Figure 4.

Figure 4 - Income and expenses of PSC TAIF-NK for 2006 – 2008, billion rubles.

Net profit is the profit that remains at the disposal of the enterprise after paying all taxes, economic sanctions and contributions to charitable foundations. Dividends are paid to shareholders from net profits, reinvestments are made in production and the formation of funds and reserves.

Change in net profit in 2007 compared to the previous year:

In absolute terms: 4582285 thousand rubles. – 1953795 thousand rubles. = 2628490 thousand rubles.

In relative terms: 4582285 thousand rubles. / 1953795 thousand rubles * 100% = 234.5%

Those. in 2007, net profit increased significantly by 2,628,490 thousand rubles (or 134.5%).

Change in net profit in 2008 compared to 2007:

In absolute terms: 5271560 thousand rubles. – 4582285 thousand rubles. = 689275 thousand rubles.

In relative terms: 5271560 thousand rubles. / 4582285 thousand rubles * 100% = 115% I.e. in 2008, net profit increased by 689,275 thousand rubles (or 15%). Net profit of TAIF-NK PSC for 2006 - 2008 is clearly presented in Figure 5.

Figure 5 – Net profit of PSC TAIF-NK for 2006 – 2008, billion rubles.

Thus, the financial results of the enterprise can be characterized as positive. However, profit cannot be considered as a universal indicator of production efficiency. In market conditions, an enterprise strives to maximize profits, which can lead to negative consequences. Therefore, to assess the intensity and efficiency of production, indicators of profitability and solvency are used.

The financial position of PSC TAIF-NK largely depends on its ability to generate the necessary profit.

The purpose of analyzing the profitability of TAIF-NK PSC is to assess the ability of the enterprise to generate income on the capital invested in the enterprise.

Profitability indicators characterize the final results of business more fully than profit, because their value shows the relationship between the effect and the available or used resources.

They are used to evaluate the activities of an enterprise and as a tool for investment policy and pricing.

The investment attractiveness of the organization and the amount of dividend payments depend on the level of profitability of TAIF-NK PSC.

When studying the final financial results of the activities of PSC TAIF-NK, it is important to analyze not only the dynamics, structure, factors and reserves of profit growth, but also the ratio of the effect (profit) with available or used resources, as well as with the enterprise’s income from its ordinary and other economic activities. activities. This ratio is called profitability and can be represented by three groups of indicators:

Profitability indicators characterizing the profitability of sales or the profitability of products sold;

Profitability indicators characterizing the profitability of production and ongoing investment projects;

Profitability indicators characterizing the return on capital and its components such as equity and debt capital.

Profitability is one of the main cost-quality indicators of the efficiency of an enterprise, characterizing the level of return on costs and the degree of use of funds in the process of production and sale of products (works, services).

Profitability indicators are expressed as ratios or percentages and reflect the share of profit from each monetary unit of costs. Thus, the final results of business are characterized more fully than profit.

The amount of profit and the level of profitability of PSC TAIF-NK depend on the production, sales and commercial activities of the enterprise, i.e. These indicators characterize all aspects of management.

The main objectives of the analysis of the financial results of the activities of PSC TAIF-NK are:

Monitoring the implementation of product sales and profit plans, studying the dynamics of indicators;

Determining the influence of both objective and subjective factors on the formation of financial results;

Identification of profit growth reserves;

Assessing the enterprise’s performance to take advantage of opportunities to increase profits and profitability;

Development of measures for the use of identified reserves.

The main goal of financial analysis is the development and adoption of informed management decisions aimed at increasing the efficiency of an economic entity.

The financial results of TAIF-NK PSC are expressed in the ability of a particular enterprise to increase its economic potential.

In general, the performance of any enterprise can be assessed using absolute and relative indicators.

The financial results of an enterprise are determined primarily by the quality indicators of the products produced by the enterprise, the level of demand for these products, since, as a rule, the bulk of the financial results is profit (loss) from the sale of products (works, services).

The financial result of an enterprise's activities serves as a kind of indicator of the significance of this enterprise in the national economy.

In market economic conditions, any enterprise is interested in obtaining a positive result from its activities, since thanks to the value of this indicator, the enterprise is able to expand its capacity, financially interest the personnel working at this enterprise, pay dividends to shareholders, etc.

Financial performance indicators characterize the efficiency of the economic activities of PSC TAIF-NK in all main areas of its work: construction, financial, investment.

They form the basis for the development of the organization and are the most important in the system for assessing the results of the enterprise’s work, in assessing the reliability and its financial well-being.

A whole set of indicators assesses the profitability or profitability of an enterprise by type of activity and areas of investment for a specific time period.

Calculation of these indicators of PSC TAIF-NK for 2006-2008. presented in Table 5.

Table 5 - Calculation of profitability indicators of PSC TAIF-NK for 2006-2008, %

| Index | Formula for calculating the indicator based on reporting data | Calculated values of the indicator | ||

| 2006 | 2007 | 2008 | ||

| 1. Return on assets (economic profitability ratio) | Page 190 f.2/ Page 300 f.1 |

9 | 13 | 15 |

| 2. Return on equity (financial profitability ratio) | Page 190 f.2/ (p.490-p.450) f.1 |

136 | 84 | 32 |

| 3. Sales profitability (commercial profitability ratio) | Page 050 f.2/ Page 010 f.2 |

7 | 11 | 12 |

| 4. Profitability of current costs |

(p.020+p.030+p.040) f.2 |

8 | 12 | 13 |

| 5. Profitability of non-current assets | Page 190 f.2 |

18 | 25 | 23 |

The main indicators of enterprise profitability are:

Return on assets;

Return on equity;

Sales profitability;

Profitability of current costs;

Return on invested (used) capital.

Let's present these indicators in the form of a diagram (Figure 6).

Figure 6 - Dynamics of profitability indicators of TAIF-NK PSC for 2006-2008, %

Analyzing the data presented in Table 5 and Figure 6, the following should be noted: according to the reporting data, the enterprise PSC TAIF-NK uses its existing assets and share capital quite effectively, since the return on assets and equity ratios in 2006 were respectively 9 and 136%.

Let's analyze the profitability of the usual activities of this enterprise. The profitability of product sales in the reporting period was 12%, in the previous period - 11%. The return on operating costs in 2008 was 13%, in the previous year 2007 - 12%. These are not bad indicators – average for the industry. The profitability of non-current assets increases in 2007 and decreases in the reporting period. A more detailed analysis is the solvency ratios, which determine the degree and quality of coverage of short-term debt obligations with liquid assets. In other words, an enterprise is considered liquid when it is able to meet its short-term obligations by selling current assets.

Various solvency indicators not only characterize the stability of the organization’s financial condition under different methods of accounting for the liquidity of funds, but also meet the interests of various external users of analytical information. Thus, a commercial bank, when providing a loan to an enterprise, pays close attention to the value of the quick liquidity ratio, since the amount of receivables can be used as collateral when issuing a loan. Based on the balance sheet data at PSC TAIF-NK, the coefficients characterizing solvency have the following values (Table 6).

Table 6 - Solvency indicators of PSC TAIF-NK for 2006-2008.

The data in Table 6 shows an increase in the liquidity ratios of TAIF-NK PSC from year to year. During 2007, the absolute liquidity ratio increased by 0.13 points. It shows that by the end of 2007, TAIF-NK PSC could pay off 17% of short-term liabilities through the use of cash and securities. If we compare the value of the indicator with the recommended level (0.2-0.3), it can be noted that the company has enough cash to cover current obligations. This circumstance can inspire confidence in this enterprise on the part of suppliers of material and technical resources. The quick ratio shows that at the end of 2006, short-term debt obligations were covered by 54% of cash, securities and settlement funds. By the end of 2008, the coefficient increased by 1.78 points. This shows that current liabilities can be repaid by the most liquid assets and quick-selling assets by 232%. Total liquidity ratio for 2006-2008. increased compared to 2006 by 2.14 points to 3.05 points by the end of the year. The company covers short-term debt obligations with liquid assets. This circumstance indicates a low financial risk associated with the fact that the company is not able to pay its bills. Thus, the enterprise PJSC TAIF-NK can be characterized as profitable and solvent. During the period from 2006 to 2008, PSC TAIF-NK tended to increase the level of profitability and solvency.

Analysis of the financial and economic activities of an enterprise involves a comprehensive study of the technical level of production, the quality and competitiveness of products, the provision of production with material, labor and financial resources and the efficiency of their use. It is based on a systematic approach, comprehensive consideration of various factors, high-quality selection of reliable information and is an important management function.

Based on the results of the study, the following conclusions can be drawn:

Financial results, which are one of the central performance indicators of enterprises, are used today as a guideline reflecting the direction of development of the enterprise. They are included in the enterprise development program, showing the final significance of the implementation of a set of strategic and tactical tasks.

In connection with the above, the procedure for generating and analyzing financial results, forecasting the results of enterprise activities, as well as the role of financial results in relation to the task of enterprise management are of particular importance.

The information base for analyzing the financial results of an enterprise is the following sources: “Report on financial results and their use”, “Balance sheet of the enterprise”, as well as accounting data, working materials of the financial department (service) and the legal adviser of the enterprise. To conduct a comparative analysis, it is recommended to use diverse information from other enterprises with similar activities that characterize their financial performance.

Financial performance indicators characterize the absolute efficiency of the enterprise's management. The most important among them are profitability indicators, which, in the conditions of transition to a market economy, form the basis for the economic development of an enterprise. Income growth creates a financial basis for self-financing, expanded production, and solving problems of social and material needs of the workforce. At the expense of income, part of the enterprise’s obligations to the budget, banks and other enterprises and organizations is also fulfilled.

The financial results of the enterprise can be characterized as positive. However, profit cannot be considered as a universal indicator of production efficiency. In market conditions, an enterprise strives to maximize profits, which can lead to negative consequences. Therefore, to assess the intensity and efficiency of production, indicators of profitability and solvency are used

The enterprise PJSC "TAIF-NK" is quite profitable and solvent. Over the period from 2006 to 2008, PSC TAIF-NK has tended to increase its level of profitability and solvency.

Based on the conclusions made, in order to increase the efficiency of the financial and economic activities of TAIF-NK PSC, it is proposed:

Getting rid of ineffective short-term financial investments;

Reducing safety stocks of inventory items;

Optimization of pricing policy;

Sale of retiring or unused property.

Reducing contributions to reserve and other insurance funds made at the expense of profits.

Increasing the term for providing trade credit by suppliers;

Analysis of activities and identification of the most pressing financial problems;

These proposals will help the TAIF-NK PSC enterprise improve its performance, increase the enterprise's profit, and increase its level of profitability.

1. Abryutina, M.S. Economic analysis of economic activity: Textbook / M.S. Abryutina. – M.: Infra, 2006.

2. Artemenko, V.G., Belelndir M.V. Financial analysis: Textbook, 4th ed., revised. and additional / V.G.Artemenko, M.V.Bellendir. - M.: Delo, 2006.

3. Balashov, V.G., Irikov V.A. Technology for improving the financial results of enterprises and corporations / V.G. Balashov, V.A. Irikov. - M.: PRIOR Publishing House, 2007.

4. Barngolts, S.B. Economic analysis of economic activities of enterprises and associations: Textbook. – 4th ed., revised. and additional / S.B. Barngolts. – M.: Finance and Statistics, 2006.

5. Bortnikov, A.P. On the solvency and liquidity of an enterprise / A.P. Bortnikova // Accounting. - 2005. - No. 11.

6. Bukhonova, S.M., Doroshenko, Yu.A., Benderskaya, O.B. Comprehensive methodology for analyzing the financial stability of an enterprise / S.M. Bukhonova, Yu.A. Doroshenko, O.B. Benderskaya // Economic analysis: theory and practice. - 2005.

7. Goncharov, A.I. Assessing the solvency of an enterprise: the problem of the effectiveness of criteria / A.I. Goncharov // Economic analysis: theory and practice. - 2005.

8. Dontsova, L.V. Drawing up and analysis of annual financial statements / N.A. Nikiforova. - M.: ICC "DIS", 2007.

9. Dontsova, L. V. Analysis of financial statements: textbook. - 3rd ed., revised. and additional / N.A.Nikiforova. – M.: Publishing house "Delo and Service", 2005.

10. Endovitsky, D. A. Systematic approach to the analysis of financial stability of a commercial organization / D. A. Endovitsky // Economic analysis: theory and practice. - 2005.

11. Eremenko, Yu. Efficiency designer / Yu.K. Eremenko // ZHUK. – 2006.

12. Efimova, O.V. Analysis of liquidity indicators / O.V. Efimova // Accounting. - 2007.

13. Efimova, O.V. Annual reporting for the purposes of financial analysis / O.V. Efimova // Accounting. - 2009.

14. Ilyasov, G.A. Assessing the financial condition of an enterprise / G.A. Ilyasova // Economist. - 2010.

"Information support for analysis"

Elements of an economic analysis information system

Sources of information are divided into:

1. Accounting

Accounting data

Statistical data

Operational accounting data

Management accounting data

Custom Credentials

2. Off-account

Regulatory material

Materials of external and internal audits, materials of tax services inspections